Financial Modeling Agent

Build and update comprehensive financial models

Transform days of financial modeling work into minutes with AI. Create detailed three-statement models, run valuation analysis, build merger models and more with minimal effort and professional-grade quality to focus on what really matters.

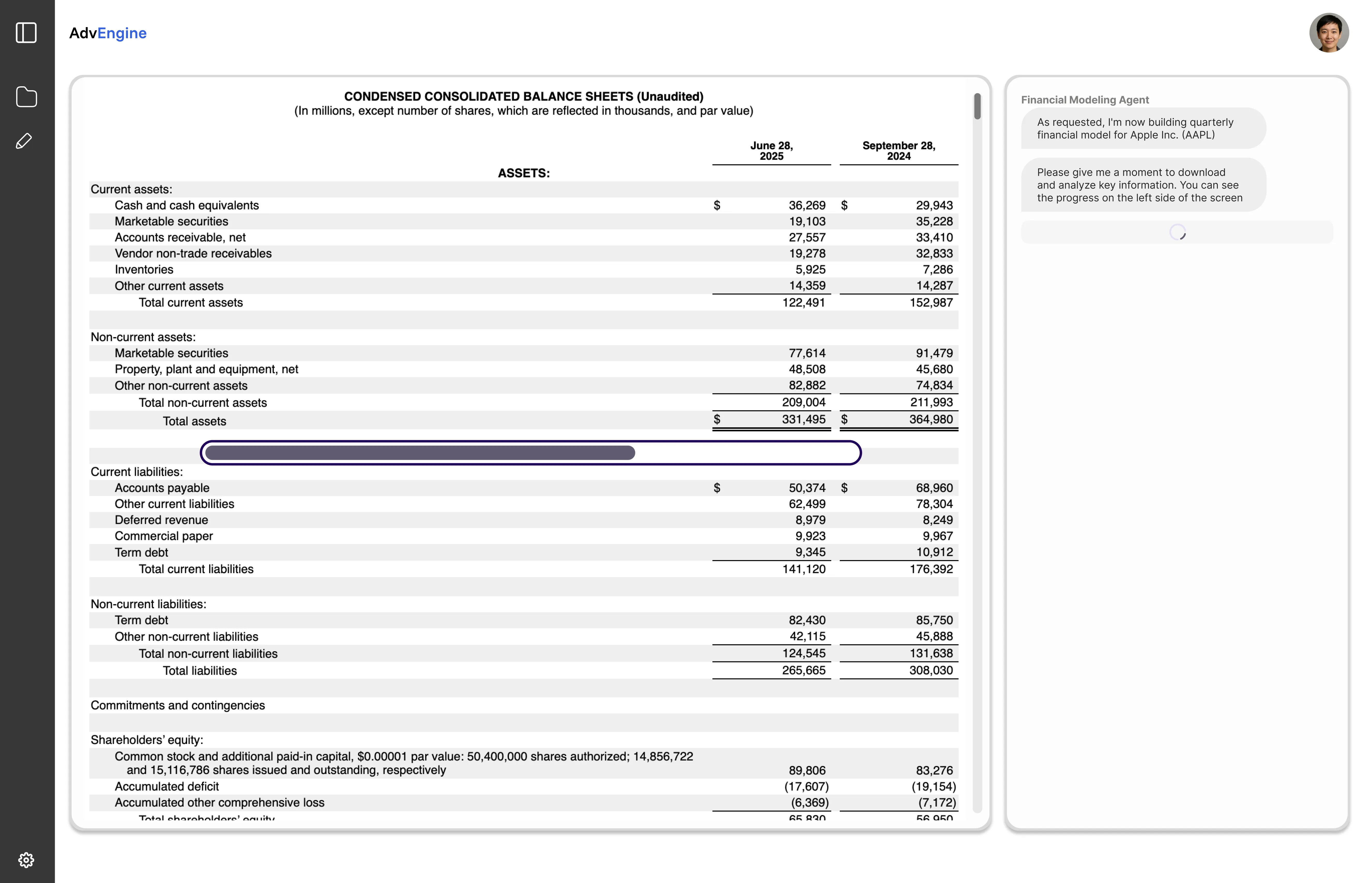

Financial Modeling Agent Demo Screen

Financial Modeling Agent's Features & Capabilities

Comprehensive financial modeling capabilities with industry-standard precision and best practices

Three-Statement Models

Build detailed three-statement models with ease - income statement, balance sheet, and cash flow with automated calculations and linkages. Add scenarios and sensitivity analysis

Valuation Layer

Add comprehensive valuation analysis including DCF (FCFF, FCFE), IRR, LBO, AVP and other valuation methodologies

Merger & Aggregation Models

Build merger and aggregation models consisting of smaller models seamlessly

Custom Analysis

Add specific custom analysis tailored to your unique requirements and investment thesis

Intelligent Assumptions

Let AI find assumptions and information that is most relevant to make data-driven modeling decisions

Designed for Accuracy & Best Practices

Eliminate common errors, get well-formatted models that are easily understandable, auditable, and incorporate industry best practices

How Financial Modeling Agent Works in General

From company selection to comprehensive financial model in minutes, not days

Tell Us What Company You Want to Model Your input

Simply tell us what company you want to model - whether public or private

Information Gathering & Analysis Agents take 2-3 minutes

Financial Modeling Agent takes a couple of minutes to find information in public sources, our internal databases, and paywalled systems (to which we have access). Once information is collected, it is thoroughly analyzed

Note: For private companies, we most likely need to ask you to upload financials since information is not always available in public sources

Review Modeling Plan Your input

Once the analysis is finished, the agent comes back to you with a detailed plan on how to model every single line of financial statements. You can either simply confirm it or easily change any line to different modeling logic and submit for further processing

Model Building & Assumptions Agents take 2-3 minutes

The model is built in seconds and then Financial Modeling Agent works on deriving the most relevant assumptions (by analyzing historical trends, industry dynamics, earnings call transcripts, news, MD&A etc.) and puts those assumptions to the model. This usually takes another couple of minutes

Download Your Model

After this, you can easily download an Excel (LibreOffice/Google Sheets) file with a full-scale detailed model containing three statements with detailed modeling of every line, and your preferred valuation analysis (DCF, IRR, LBO, AVP...). All this in minutes with minimum effort and confidence that your model has no linking errors, is well-formatted, auditable, and incorporates industry best practices

Note: Most likely, you'll need to invest some time in understanding company operations or reviewing/tweaking your assumptions. Still, this saves you days of work

Iterate & Refine Coming soon

If you would like to implement changes to the model, you can do so using our chat interface or our plugins (in test mode)

Use Cases

Empowering professionals and individuals to make better investment decisions

Investment Banking / Corporate Development

- • Build comprehensive financial models for pitch decks or M&A transaction execution with professional-grade quality

- • Generate essential outputs including "Football Field" valuation charts, sensitivity analysis tables, and scenario comparisons in minutes with confidence

Investment Funds

- • Easily build detailed financial models to identify and evaluate investment opportunities

- • Monitor portfolio companies

- • Deploy sophisticated investment strategies by understanding valuation levels across markets and sectors

- • Effortlessly keep models up to date each quarter, half-year, or year as new results are released

Individual Investors

- • Invest like a professional by building institutional-quality financial models and understanding key valuation drivers

- • Gain deep insights into company operations and growth potential

- • Access professional-grade investment tools to build and manage a high-quality investment portfolio

Works with Both Public and Private Companies

Comprehensive support for all types of companies with intelligent data extraction

Public Companies

For public companies, Financial Modeling Agent downloads information from public domains and paywalled databases (to which we have access)

- • Public domain sources and SEC filings*

- • Paywalled databases (to which we have access) and research platforms

- • Earnings and investor presentations

- • Event call transcripts and news

* See FAQ below on this page for more details for non-SEC filing companies

Private Companies

For private companies, users can either upload files and AI will extract information, or upload information in a predefined format.

- • Upload any format - AI extracts and structures

- • Review and confirm extracted data

- • Use pre-formatted templates

- • Combine internal data with market intelligence

What's Next for Financial Modeling Agent?

Continuous innovation to make the Financial Modeling Agent even more useful

Automatic Model Updates

Every quarter, half-year, or year it is likely that you'll have to update your model with newly issued numbers. Financial Modeling Agent can take care of this and analyze latest reporting, transcripts, and news and update your spreadsheet saving you tons of time

Sector Specific Datasets

Advanced models for specific sectors with relevant metrics and paywalled data sources

Aggregation and Merger Models

Build complex models combining multiple subsidiary/segment models and Advanced M&A modeling with accretion/dilution analysis and other relevant metrics

Support for Financial Institutions & REITs

Specialized modeling for banks, insurance companies, and REITs with relevant metrics

Automatic Financials Download

Support for non-SEC filing companies globally

Excel Plugin

Direct integration within Excel for seamless workflow

Support for Complex Custom Instructions

Multi-step custom modeling of complex logic tailored to your needs

Support for Custom Templates

Use your own templates and formatting preferences

API Access

Integrate Financial Modeling Agent into your existing systems

Frequently Asked Questions

Does the agent work as a web-based solution or an Excel plugin? ▾

Currently, it works from your browser, emulating a standard spreadsheet and showing you outputs. We are working hard to make this spreadsheet as functional as possible. We are also developing an Excel plugin for users who want to work directly in Excel

How accurate are the models? ▾

While every AI product has some probability of "hallucinations," we've designed our solution to minimize this risk. This resulted in certain trade-offs (which we mitigate through other approaches), but we believe accuracy is critical in model building. Our approach results in one of the most accurate AI products available. We also make our models very transparent, so it is easy for users to audit them once they receive the first draft

Can I use my own assumptions? ▾

Absolutely! You can modify any assumptions and any processing line. You are always in control. Even though it might look like Financial Modeling Agent does everything, in reality, the agent simply makes suggestions and builds things only after you confirm or amend these suggestions. You have full control over all inputs and can adjust them based on your preferences

How long does it take to build a model? ▾

The agent itself takes a couple of minutes to download all data, analyze it, and provide an action plan with suggestions. Then it takes another couple of minutes to determine the right set of assumptions. In total, the agent takes 5-10 minutes to perform its work. However, the complete process from start to finish may take longer depending on user preferences and company knowledge. If you're performing fundamental analysis of an unfamiliar company, expect to spend a couple of hours (depending on company complexity and analysis depth) understanding operations and developing assumption preferences. Unfortunately, we cannot speed up this part, but this still saves days or even weeks of manual work

What types of analysis and valuations are supported? ▾

Financial Modeling Agent supports DCF (Discounted Cash Flow) using both FCFF and FCFE approaches, LBO (Leveraged Buyout), IRR (Internal Rate of Return), Analysis at Various Prices (AVP), and other share-related metrics, among others. We are working on adding more options based on user feedback and can consider adding custom valuation approaches. You can combine multiple approaches in a single model

Do you support non-US companies? ▾

Yes, the model is agnostic in this respect - public, private, any geography. However, it's a bit more complicated. For US public companies (and non-US companies reporting to the SEC), we can easily obtain data from multiple sources with high assurance of data quality. Non-public and non-SEC reporting companies don't always have easily accessible and readable financials and other reports. We're working hard to train our agents to get these financials automatically, but for now, we rely on users to upload such data to avoid mistakes and frustration. We expect to soon have automatic data retrieval for public companies with high precision. For private companies, users will still need to upload data since it's usually impossible to obtain such data without internal access